section 179 tax benefit

What is Section 179? Directly from Section179.org (please visit page for most up to date info)

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Section 179 always expires at midnight, December 31st. So to take advantage of Section 179 this year, you must buy (or lease/finance) your equipment, and put it into use, by December 31st of this year.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Section 179 always expires at midnight, December 31st. So to take advantage of Section 179 this year, you must buy (or lease/finance) your equipment, and put it into use, by December 31st of this year.

How Section 179 Works?

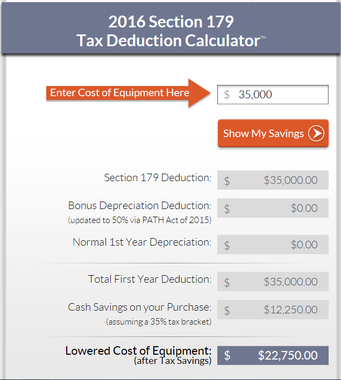

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That's the whole purpose behind Section 179 - to motivate the American economy (and your business) to move in a positive direction. For most small businesses, the entire cost can be written-off on your tax return.

Section 179 at a Glance (please visit section179.org for complete up to date info)

Jan 4, 2019 – Section 179 is one million dollars for 2019, as stated in H.R.1, aka, The Tax Cuts and Jobs Act.The deduction limit for Section 179 is $1,000,000 for 2019 and beyond, while the limit on equipment purchases remains at $2.5 million. Further, the bonus depreciation is 100% and has been made retroactive to 9/27/2017. It is good through 2022. The bonus depreciation also now includes used equipment.

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That's the whole purpose behind Section 179 - to motivate the American economy (and your business) to move in a positive direction. For most small businesses, the entire cost can be written-off on your tax return.

Section 179 at a Glance (please visit section179.org for complete up to date info)

Jan 4, 2019 – Section 179 is one million dollars for 2019, as stated in H.R.1, aka, The Tax Cuts and Jobs Act.The deduction limit for Section 179 is $1,000,000 for 2019 and beyond, while the limit on equipment purchases remains at $2.5 million. Further, the bonus depreciation is 100% and has been made retroactive to 9/27/2017. It is good through 2022. The bonus depreciation also now includes used equipment.